Everyone knows that Florida is one of the most popular retirement destinations in the country, and most people attribute that fact to our ideal climate, beautiful white sand beaches, and the plethora of outstanding retirement communities that have sprung up across the state.

However, one often overlooked factor that makes Florida a great retirement destination is all of the tax advantages that are offered to our residents. Those benefits start with the fact that we have no state income tax, but the savings actually go much deeper than that.

Let’s take a quick look at some of the many tax-friendly aspects of life in Florida!

No State Income Tax

Income tax rates vary dramatically as you move from state-to-state across the country. The average person in Pennsylvania pays a modest 3.07% in state income taxes, while the same person in California is staring down the barrel of 13.3%.

That number falls to zero here in Florida. So if you plan on earning any income at all during your retirement years, there are some serious financial advantages to living in the Sunshine State.

Reasonable State Sales Tax

Operating without a state income tax is just the tip of the tax-friendly iceberg here in Florida. We also have a very modest 6% state sales tax that applies to all purchased goods outside of food, as well as prescription and non-prescription drugs.

The difference of a few percent in sales tax might not seem like a big deal, but when you calculate how much it adds up to over the course of a few decades of retirement, we end up talking about some pretty big numbers.

Low Property Taxes

Another area where Florida residents are able to save money is when those annual property taxes come due. A Florida home that is $400,000, depending on where that home is located, it’s owners can generally expect to pay about $4,100 in property taxes.

On top of those already low property taxes, Florida also offers a fantastic Homestead Exemption Program that can reduce that tax burden even further for anyone who claims their Florida home as their primary residence.

Even More Tax Benefits

Still not impressed? That’s ok. We’ve got even more tax benefits to talk about!

Florida residents also benefit from lower gas taxes than many other states. They also find that the 6% state sales tax can make a big difference when purchasing a vehicle. So at the end of the day, all of your vehicle expenses are going to be lower here in Florida.

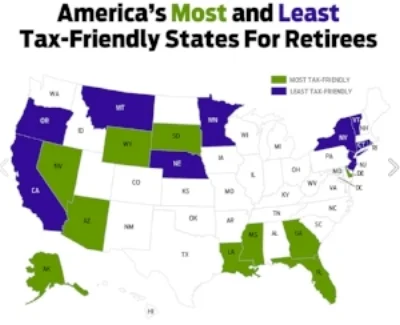

In one popular publication, Florida was ranked third behind only Wyoming and Alaska for the most tax-friendly state. So when you combine those tax advantages with our warm climate, picture-perfect beaches, and all of the great choices of communities, it’s hard not to see the value in retiring to Florida.